Pages

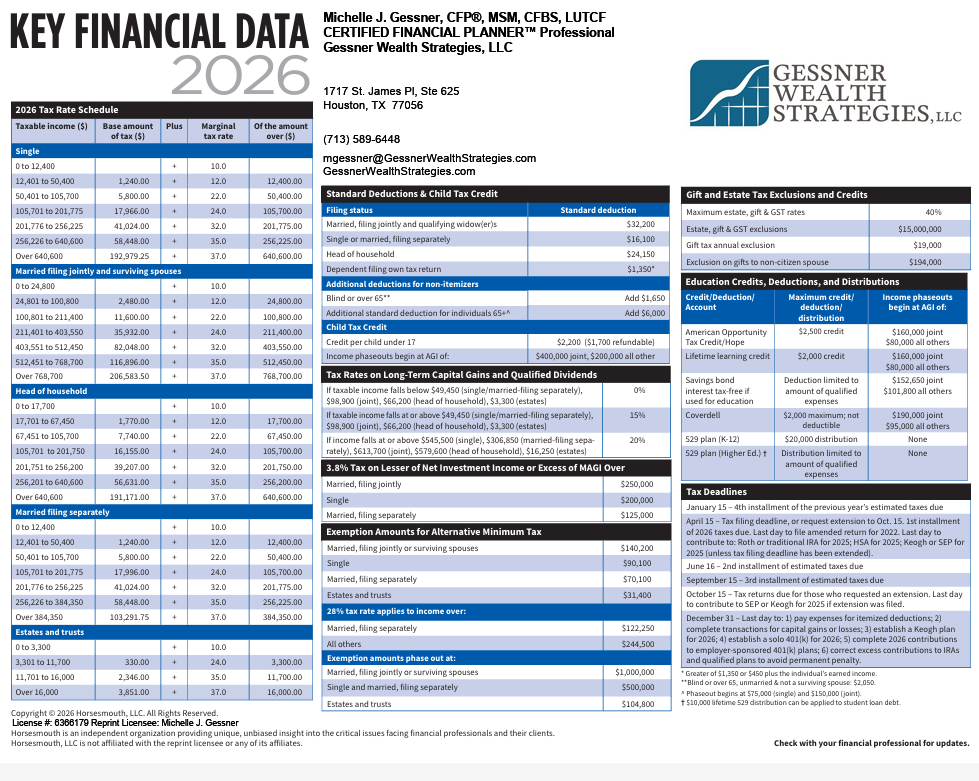

- Grab Your 2025 Tax Cheat Sheet!

- What Others Are Saying

- Will Higher Tax Rates Crush Your Retirement Gains Guide

- Questions to Ask an Advisor Guide

- Podcast (Ep. 3)

- Podcast (Ep. 2)

- Podcast (Ep. 1)

- Podcast

- Retire to a Life You Love®Webinar

- Hope is Not a Strategy

- Quick Guides

- Houston Retirement Planning: Winning Strategies from Michelle Gessner, CFP®

- Ebooks

- Gessner Wealth Strategies Videos

- financial consultant

- Local Wealth Management Firm Completes Advanced Virtual Training

- Wealth Management Houston

- Financial Planner Houston

- Citations

- Financial Advisor

- Points of Interest Around Gessner Wealth Strategies

- About Houston, TX

- Directions to Gessner Wealth Strategies

- Events Near Gessner Wealth Strategies

- Index

- learn how to build a tax free retirement b

- learn how to build a tax free retirement replay b

- tax free retirement video

- Build a Tax Free Retirement

- Articles

- Thanks!

- Thank You

- Acuity Test

- Client Login

- Informative Guides and Articles

- Blog

- Investment Management

- Services

- Fiduciary

- Important Disclosures

- Getting to Know You

- Risk Assessment

- Contact us

- Home

- About Gessner Wealth Strategies

- Becoming a Client

- Who We Serve

- What We Do

- FAQs

- Privacy Policy

Posts

401(k) plan rollover to IRA

- Should I Keep my Money in my 401(k) or Roll it Over to an IRA? - 25 February 2025

Annuities

- Annuities: Are They a Good Move? - 2 February 2020

Bonds

- Are You Taking Too Much Risk with Your Bonds (Or Paying Too Much)? - 14 October 2019

Buying a House

- The Smart Seller’s Guide: 6 Mistakes to Avoid When Selling Your Home - 14 November 2025

- Sick of Renting? Follow these Tips when Buying a Home - 1 December 2019

Cybersecurity

- Credit Freeze Quick Take - 31 March 2025

- Avoiding Financial Scams and Identity Theft Slams Quick-Reference - 20 April 2023

- Is Your Investment Account Safe from Fraud and Cyber Thieves? - 25 January 2020

Education Planning

- College Payment Strategies: Where Should the Money Come From? - 8 December 2025

- What You Need to Know About The One Big Beautiful Bill - 16 October 2025

- Quick Take: What to Do With a 529 Balance - 19 June 2025

Estate Planning

- How to Have Family Conversations About Money - 12 February 2026

- Educating the Next Generation About Family Wealth Management - 23 September 2025

- Client Question: What Should I Do With an Inherited IRA? - 2 September 2025

- Marriage Equality, Parental Rights & Estate Planning: Why Every Couple Needs a Plan - 30 July 2025

- Protecting What’s Yours (After You Pass) Part 2: Step-by-Step Estate Planning - 18 May 2023

- Protecting What’s Yours (After You Pass) Part 1: The Importance of Estate Planning - 18 May 2023

- Do I Really Need an Estate Plan? (And other questions for attorney Katherine Boyd) - 18 October 2022

- What Issues Should I Consider During a Recession or Market Correction? - 3 October 2022

- 7 Ways to Derail Your Investment Portfolio - 27 December 2020

Insurance

- How to Have Family Conversations About Money - 12 February 2026

- Homeowners Insurance Rates Are Rising. What Does That Mean for You? - 11 July 2025

- Disability and Life Insurance for Your Adult Children – How Does That Affect Your Retirement? - 25 November 2019

- It Doesn’t Go On Sale: Don’t Wait Until You’re Older for Long Term Care Coverage - 28 October 2019

Investing

- How to Have Family Conversations About Money - 12 February 2026

- Five Behavioral Finance Resolutions for a Better Financial Year - 16 December 2025

- Educating the Next Generation About Family Wealth Management - 23 September 2025

- Client Question: What Should I Do With an Inherited IRA? - 2 September 2025

- Timeless Wisdom from Warren Buffett - 19 June 2025

- Client Question: Should I Be Using a Health Savings Account? - 20 May 2025

- The Age of the Finfluencer: Who Should You Listen to When Everyone’s Talking? - 6 May 2025

- Disruptive Forces: Thriving in a World that Won’t Sit Still - 17 March 2025

- Client Question: How Can I Give My Kids a Head Start on Investing? - 17 March 2025

- Should I Keep my Money in my 401(k) or Roll it Over to an IRA? - 25 February 2025

- Counterintuitive Money Advice: Investing Against the Grain - 12 February 2025

- Your 2024 Year-End Planning Guide - 13 December 2024

- Client Question: I’ve Got a Lump Sum in Cash, Should I Invest It Right Away? - 14 October 2024

- What We Talk About When We Talk About Volatility: Magnitude vs Percentage - 30 August 2024

- Financial Quick Takes: Compound Returns - 13 August 2024

- Equity Compensation: Big Opportunities, But Beware the Risks - 2 July 2024

- Money Management Lingo - 17 June 2024

- Young Investor’s Guide to Building a Financial Future - 17 June 2024

- Making Best Use of Your Behavioral Biases: How To Trick Yourself - 22 May 2024

- Financial Quick Takes: Financial Goals, Your Tickets To Ride - 22 May 2024

- Putting the Stock Market in Context - 23 April 2024

- Bringing Order to Your Investment Universe Part 2: Transitions and Taxes - 19 March 2024

- Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized - 19 March 2024

- Are You Confused About Investment Costs? Fund Management Fees - 16 February 2024

- What Is Liquidity? - 16 February 2024

- Evidence-Based Investment Insights: Ignoring the Siren Song of Daily Market Pricing - 23 January 2024

- Evidence-Based Investment Insights: You, the Market, and the Prices You Pay - 23 January 2024

- 4 Financial Best Practices for Year-End 2023 - 19 December 2023

- Financial Quick Takes: Is Your Portfolio Underperforming … Compared to What? - 27 October 2023

- Financial Quick Takes: The Wisdom of Crowds vs. Popular Delusions - 11 October 2023

- Financial Quick Takes: Making Mistakes - 6 September 2023

- A Balanced Look at Stock Buybacks Part 3: Risks Amidst the Rewards - 4 August 2023

- A Balanced Look at Stock Buybacks Part 2: Sustaining Current and Future Value - 4 August 2023

- A Balanced Look at Stock Buybacks Part 1: How Do Stock Buybacks Work? - 4 August 2023

- What’s Wrong with Depending on Dividend Stocks? Part 2: Dividend Stocks vs. Total Return Investing - 29 June 2023

- What’s Wrong with Depending on Dividend Stocks? Part 1: How Dividend Stocks Really Work - 29 June 2023

- Unsung Money Mentors: Personal Financial Columnist Sylvia Porter - 15 June 2023

- Who Is “the Media”? - 3 May 2023

- Building Lifetime Wealth, 80/20 Style - 17 March 2023

- 6 Financial Action Items to Wrap-Up 2022 - 12 December 2022

- Are You In a Bad Mood or Are We In a Recession? - 2 December 2022

- Investing is Personal – Be Patient - 15 November 2022

- Understanding Stocks: The Price You Pay Matters - 3 November 2022

- Where do Stock Market Returns REALLY Come From? - 12 October 2022

- Combat Recency Bias: Focus on the Basics - 7 October 2022

- What Issues Should I Consider During a Recession or Market Correction? - 3 October 2022

- Remembering Summers Past: Don’t Fall into Recency Bias - 19 September 2022

- Market Timing: Are we predicting a happily-ever-after for 2022? - 10 September 2022

- 7 Ways to Derail Your Investment Portfolio - 27 December 2020

- Taxes, Trash, Toilets, and Tenants: Is Rental Property a Good Investment? - 23 June 2020

- Financial Tips During Covid-19 and the Market Decline – As Seen on HCC-TV - 23 June 2020

- Roth Conversions and Rebalancing: Positive Steps to Take in the Coronavirus Market Decline - 29 March 2020

- Market Timing – What if We Had a Crystal Ball? - 10 February 2020

- Annuities: Are They a Good Move? - 2 February 2020

- Is Your Investment Account Safe from Fraud and Cyber Thieves? - 25 January 2020

- Should You Do It Yourself? Investments and Financial Planning - 9 November 2019

- Inherited IRAs: Don’t Touch Without First Consulting a Professional - 17 October 2019

- Are You Taking Too Much Risk with Your Bonds (Or Paying Too Much)? - 14 October 2019

Investment Fees

- How Investment Fees and Expenses Work - 13 March 2016

Planning for Emergencies

- Five Behavioral Finance Resolutions for a Better Financial Year - 16 December 2025

- Client Question: Should I Be Using a Health Savings Account? - 20 May 2025

- Disruptive Forces: Thriving in a World that Won’t Sit Still - 17 March 2025

- Money Scripts—Part 2: How to Manage the Script - 21 January 2025

- Money Scripts—Part 1: The Stories We Tell Ourselves in Order to Live, Save and Spend - 21 January 2025

- Financial Readiness: Preparing Yourself Before Disaster Strikes - 14 November 2024

- Healing What Hurts: Can a Financial Therapist Help? - 1 February 2023

- 7 Ways to Derail Your Investment Portfolio - 27 December 2020

- Financial Tips During Covid-19 and the Market Decline – As Seen on HCC-TV - 23 June 2020

Retirement

- How to Have Family Conversations About Money - 12 February 2026

- Five Behavioral Finance Resolutions for a Better Financial Year - 16 December 2025

- What You Need to Know About The One Big Beautiful Bill - 16 October 2025

- Educating the Next Generation About Family Wealth Management - 23 September 2025

- The Power of Purpose in Retirement - 7 August 2025

- Navigating the Maze of Tax Strategies for a Secure Retirement - 11 July 2025

- Timeless Wisdom from Warren Buffett - 19 June 2025

- Client Question: Should I Be Using a Health Savings Account? - 20 May 2025

- Disruptive Forces: Thriving in a World that Won’t Sit Still - 17 March 2025

- Should I Keep my Money in my 401(k) or Roll it Over to an IRA? - 25 February 2025

- Counterintuitive Money Advice: Investing Against the Grain - 12 February 2025

- Money Scripts—Part 2: How to Manage the Script - 21 January 2025

- Money Scripts—Part 1: The Stories We Tell Ourselves in Order to Live, Save and Spend - 21 January 2025

- Financial Quick Takes: Financial Goals, Your Tickets To Ride - 22 May 2024

- Protecting Women’s Wealth - 23 April 2024

- Unsung Money Mentors: Personal Financial Columnist Sylvia Porter - 15 June 2023

- Is Social Security Going Bust? - 30 March 2023

- Social Security Planning: A Balancing Act - 16 January 2023

- SECURE 2.0 Act: What You Need To Know - 5 January 2023

- Retirement Planning in Houston: An Essential Guide - 28 July 2022

- 7 Ways to Derail Your Investment Portfolio - 27 December 2020

- Spending Money and Spending Time: Getting a Handle on Both for a Successful Retirement - 30 August 2020

- Annuities: Are They a Good Move? - 2 February 2020

- Inherited IRAs: Don’t Touch Without First Consulting a Professional - 17 October 2019

- How to Determine Your RMD (Required Minimum Distribution) - 14 October 2019

Risk Management

- How to Have Family Conversations About Money - 12 February 2026

- Disruptive Forces: Thriving in a World that Won’t Sit Still - 17 March 2025

- Counterintuitive Money Advice: Investing Against the Grain - 12 February 2025

- Financial Readiness: Preparing Yourself Before Disaster Strikes - 14 November 2024

- What Does It Take to Take on Risk? - 30 August 2024

- 7 Ways to Derail Your Investment Portfolio - 27 December 2020

Small Business Owners

- Educating the Next Generation About Family Wealth Management - 23 September 2025

- 7 Big Financial Mistakes to Avoid for Small Business Owners - 1 August 2022

Social Security

- Navigating the Maze of Tax Strategies for a Secure Retirement - 11 July 2025

- Is Social Security Going Bust? - 30 March 2023

- Social Security Planning: A Balancing Act - 16 January 2023

Taxes

- New Year, New Tax Considerations: What You Need to Know Before Filing Your 2025 Taxes - 12 February 2026

- What You Need to Know About The One Big Beautiful Bill - 16 October 2025

- Navigating the Maze of Tax Strategies for a Secure Retirement - 11 July 2025

- Tax Considerations for 2024: What You Need to Know Before Filing - 17 February 2025

- Bringing Order to Your Investment Universe Part 3: Optimizing Your Organized Investments - 19 March 2024

- Bringing Order to Your Investment Universe Part 2: Transitions and Taxes - 19 March 2024

- Financial Planning in Turbulent Times - 3 March 2023

- Tax-Wise Investment Techniques - 24 February 2023

- The Tools of the Tax-Planning Trade - 10 February 2023

- What Issues Should I Consider During a Recession or Market Correction? - 3 October 2022

- 6 Crucial Tax Strategies That Busy Professionals in Houston Should Consider - 30 July 2022

- Financial Tips During Covid-19 and the Market Decline – As Seen on HCC-TV - 23 June 2020

- 7 Tax Planning Tips to Use Now While Taxes and Stocks are On Sale - 3 May 2020

Uncategorized

- Five Behavioral Finance Resolutions for a Better Financial Year - 16 December 2025