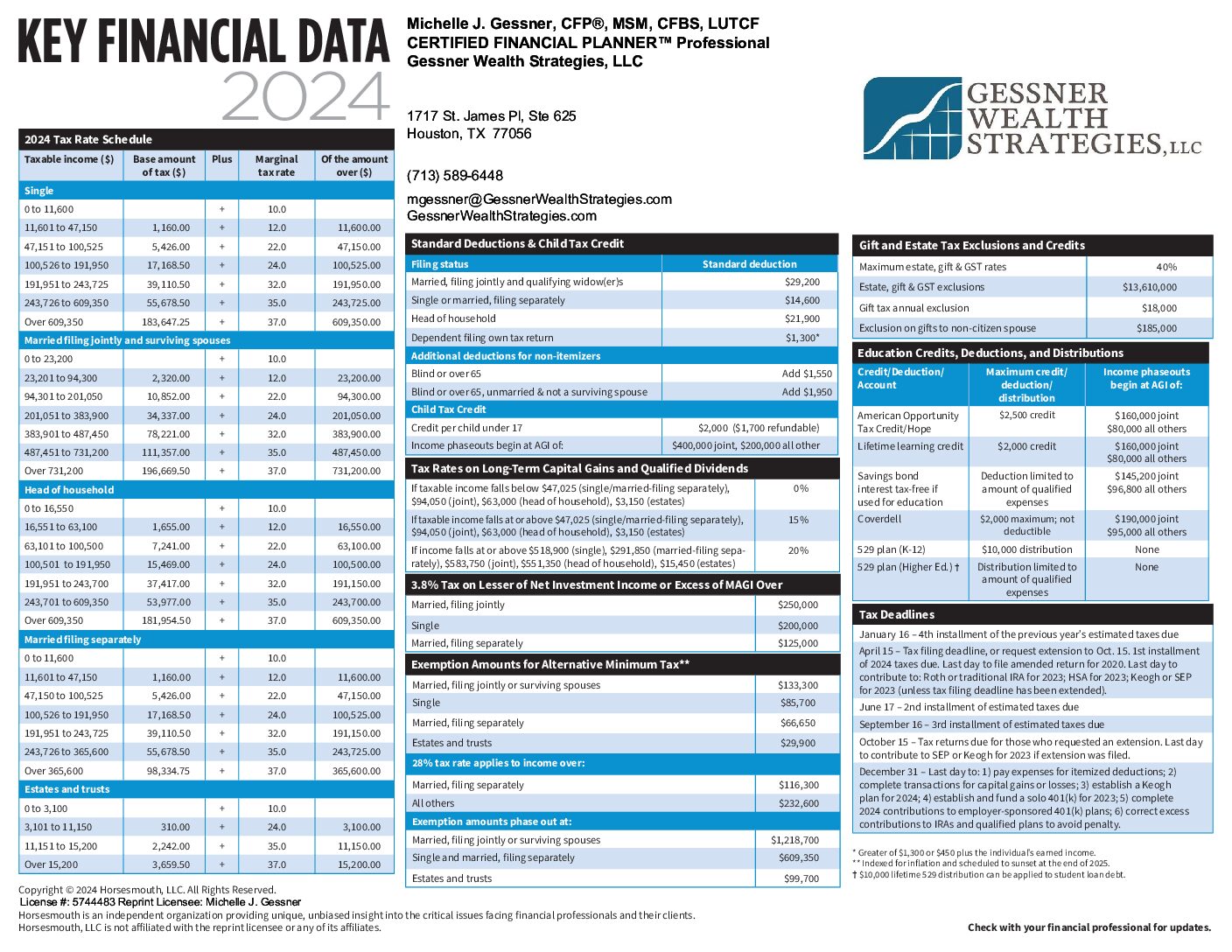

In Part 2 of our three-part series on bringing order to your investment universe, we looked at Transitions and Taxes, or how to balance sensible tax management with effective investment… Read More

Bringing Order to Your Investment Universe Part 3: Optimizing Your Organized Investments