In May, legendary investor Warren Buffett announced he will retire as CEO of Berkshire Hathaway at the age of 95. Sixty years ago, Buffett took over Berkshire Hathaway, a struggling… Read More

Timeless Wisdom from Warren Buffett

In May, legendary investor Warren Buffett announced he will retire as CEO of Berkshire Hathaway at the age of 95. Sixty years ago, Buffett took over Berkshire Hathaway, a struggling… Read More

Choosing a health care plan at work can be a bit of a headache—charts comparing premiums, copays and deductibles isn’t exactly light reading. One option you might have encountered in… Read More

On Tuesday, March 4, 2025, the Trump Administration imposed sweeping tariffs against the country’s three biggest trading partners: 25% tariffs on imported goods from Canada and Mexico and 20% tariffs… Read More

After many years of saving to your company retirement plan, you finally see the light through the end of the tunnel. Retirement is near, and there is no shortage of… Read More

There are a lot of things in life where the right move is pretty intuitive. Avoid the top rung of a ladder when you’re changing a lightbulb. Don’t click on… Read More

Understanding why we behave the way we do with money is the first step toward transforming our relationship with it. In part one of this series, we explored the concept… Read More

When it comes to our finances, we’re only human. We make good decisions and sometimes, not-so-good decisions. Behavioral biases play a big role in our savings, spending and investing decisions…. Read More

We’ve commented before on the mechanics of accumulating and preserving your wealth by building a low-cost, globally diversified investment portfolio aimed at your personal goals and risk tolerances. Today, let’s… Read More

Today, let’s turn our attention to women and their wealth. Based on available evidence, what are women’s most likely superpowers as they acquire and manage personal wealth? What vulnerabilities might… Read More

In a recent piece, Who Is “the Media?” we offered our broad take on “the media,” and how to identify islands of investment insights across the oceans of daily news. Next,… Read More

Gessner Wealth Strategies, LLC

1717 St James Place,

Suite 625

Houston, Texas 77056

Office Phone: 713-589-6448

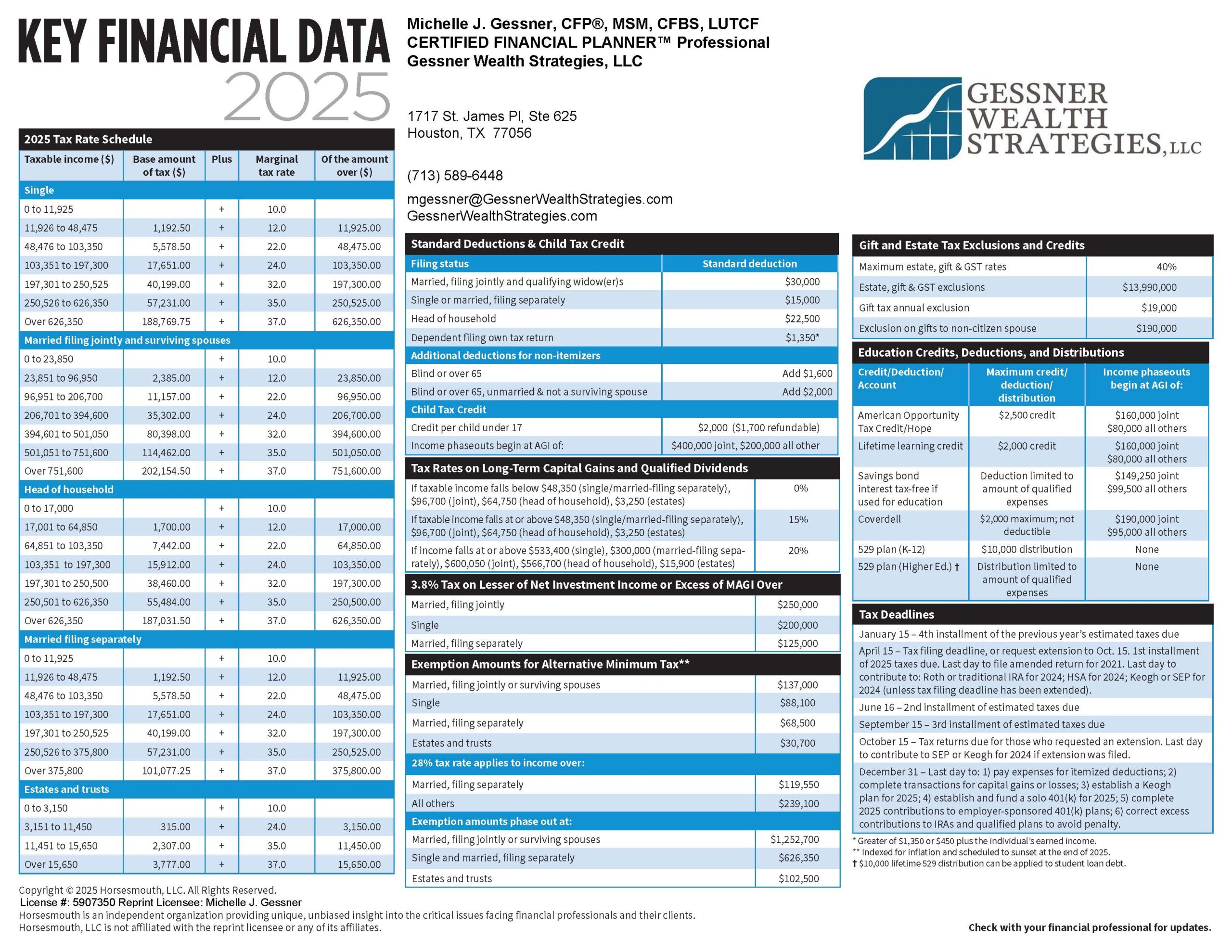

This quick reference guide (PDF) provides the most important figures you need for 2025 tax planning.

No thanks, I don't need it!

Download our white paper!

Just fill in your details below to be sent your copy of

“Evidence-Based Investment Insights: 12 Essential Ideas for Building Wise Wealth“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Download this complimentary guide and find out today!

Just fill in your details below to be sent your copy of “Will Higher Tax Rates Crush Your Retirement Gains?“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Answer the questions in this FREE Guide to find out!

Just fill in your details below to be sent your copy of “6 Important Questions to Ask Yourself Before Considering Retirement“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Get answers to critical estate planning questions… complete your details below to receive a copy

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.