We have designed this process to give you (and us) a framework for making an educated and informed decision about working together. Of equal importance, you will finish this process knowing exactly where you stand in the four key areas of retirement success.

For people who are potentially a good fit for our firm, there is no cost or obligation for this process as we want you to know exactly how we can help you before you pay us a single dollar in fees or trust us with a penny of your nest egg.

If you are the financial decision maker in your life, with a minimum of $1,000,000 to invest in your retirement, and are looking for a professional partner to help you align your money with the rest of your life, then we welcome the chance to discuss how we can work together for your success.

Initial Phone Call with Michelle

Before committing your time or ours, this 15-minute call will help us to learn more about each other to see if we are a good fit. We will talk about where you are today, what’s on your mind, if we offer the expertise you need, and whether we should take the next step. Schedule your appointment now.

Getting Ready for Our Meeting

– Information Gathering

The goal of this meeting is to get clear on your goals, concerns, and circumstances. You will receive prior to this meeting a simple data gathering questionnaire with a checklist of information to gather and bring to the meeting.

No Obligation, Complimentary Observations Meeting

Here is where you will receive our observations and ideas to consider, the steps of our process, how we can help you, and our fees. During this meeting we will ask you to communicate your financial goals, discuss your investing history, and provide us with an overview of your current financial situation. We will ask a few questions to help uncover where you stand with regard to tax rate risk as well as other risks that may apply to your situation and what can be done.

We can schedule the next visit to sign forms to get our work together started, or feel free to take your time and sleep on it and let us know when you’re ready.*

If you have additional questions or concerns that come up later about the process or the observations discussed during this meeting, please reach out so you can get the answers you need.

*While we would love to work with you, if you decide that it’s not a good fit, we will wish you all the best and every success. In other words, there is never a hard-sell or pressure to say yes. We only ask that you let us know so that we will promptly remove you from any follow ups.

Great News! We are moving forward together.

Let's Get STARTED!

Paperwork Meeting

During this meeting, we will cover all steps to open your accounts, specific investment recommendations, how to access your online portal, and what to expect from your partnership with us. You will also receive an additional goals-based questionnaire to complete that will help us understand how you wish your lifestyle to look in retirement.

Create Your Lifestyle® Plan Delivery

We will meet again a few weeks later to cover your customized Create Your Lifestyle® plan, What-If scenarios, conclusions, and implementation plan, including important strategies to potentially minimize future income taxes. Assuming the plan addresses your financial objectives, we will help you celebrate your first step to Retire to a Life You Love.®

Begin Ongoing Guidance and Reviews

We provide ongoing support and advice for financial decisions made throughout the year. We want to be the first call you make when faced with a financial challenge or opportunity, acting as your financial partner and trusted advocate to help you with financial decisions, in real-time, as they occur.

We conduct our regular review process, meeting one to two times annually.

Schedule 15-Minute Phone Call Now

Complimentary Guide:

6 Important Questions To Ask Yourself Before Retiring

Are You Prepared for a Retirement You'll Love?

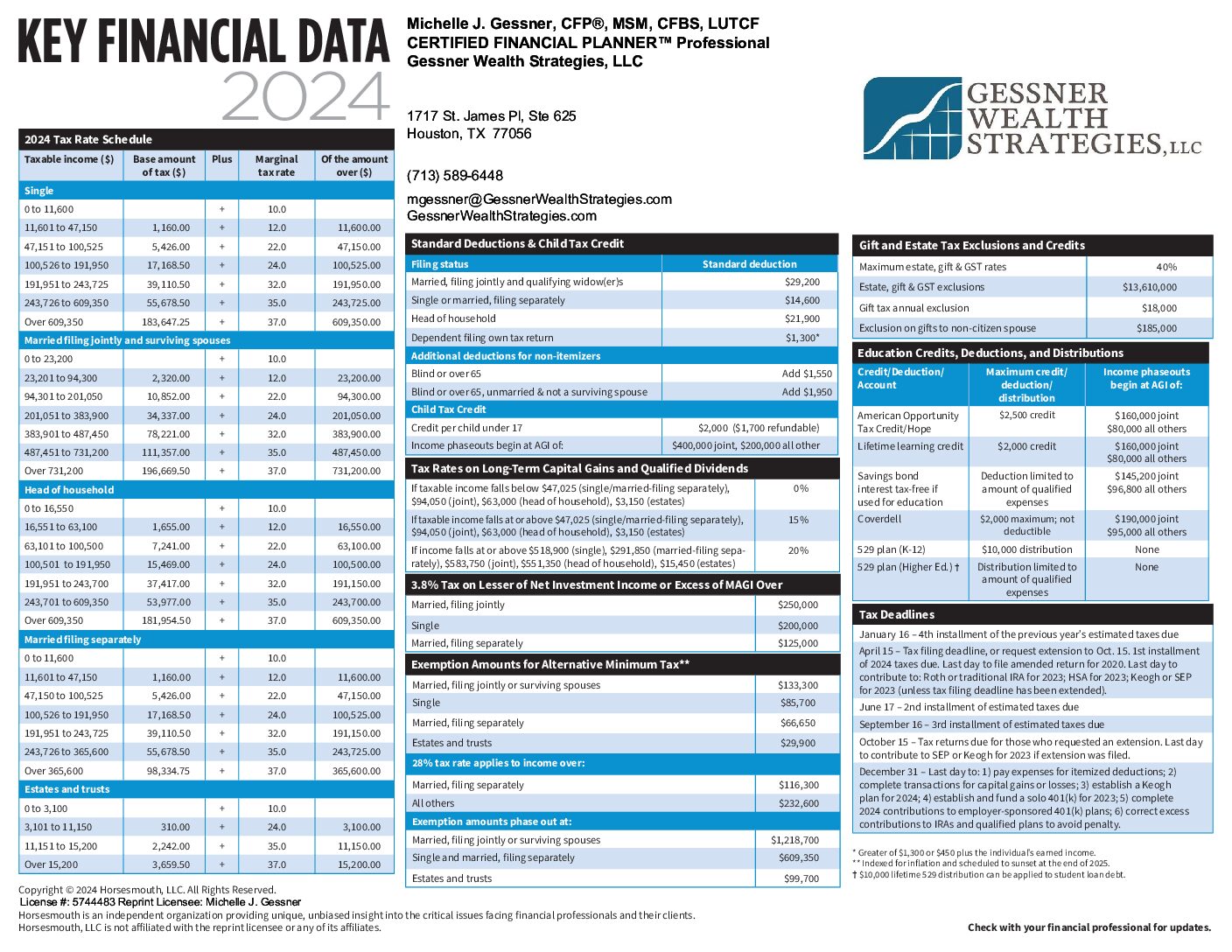

Will Higher Tax Rates

Crush Your Retirement Gains?

IMPORTANT QUESTIONS TO ANSWER NOW BEFORE IT’S TOO LATE

Are you doing everything you can to protect yourself from higher taxes in retirement? Download our complimentary guide and find out today!