Did you know that the average retirement lasts around 25 years in America? Imagine the preparations you’d need to make to live without your primary income for 25 years. The reality of retirement is that it involves careful planning and should begin early.

Even if you don’t plan to retire for decades, it’s important to understand the value of taking action now. The alternative to planning for the future is to continue working for the rest of your life, so it’s immensely valuable to make the right financial moves before you reach retirement age. Keep in mind, however, that you may not have the choice to work longer as there may be a layoff or another reason that your employment horizon is cut short.

This article answers pertinent retirement planning questions, including:

- Why should planning for retirement be a high priority?

- How do you determine how much you’ll need for a comfortable retirement?

- Do you understand your Social Security benefits and how to manage them?

- What other sources of income can enhance your retirement?

- How can a fiduciary advisor in Houston help you with retirement planning?

Care to talk to a professional about planning your retirement? Michelle Gessner, CFP®, MSM, CFBS, and LUTCF founded Gessner Wealth Strategies to help people like you. Contact us today to schedule a no-obligation meeting.

Why Plan for Retirement?

Whether retirement is a decade away or just around the corner, you’ll be glad you started planning for it early. There are smart strategies for investing regardless of your financial experience. By following fundamental strategies, you can set yourself up for a retirement that suits your lifestyle.

What Happens if You Don’t Save for Retirement Until Later in Life?

While many people may assume that they’ll be able to retire one day, the reality is that many people are never able to because they didn’t plan for it.

Not many people want to continue working well into their 70’s, so the alternative to that is to save for a comfortable retirement. By implementing tried and true investment strategies, you can make your retirement dreams a reality.

Considering More Than Just Your Money

The financial aspect of retirement planning is just one part of the equation. Retirement planning is also about your lifestyle, values, and health. For example, if the majority of your social life takes place on a golf course, will you still be able to afford that part of your lifestyle when you retire?

Applying your own circumstances and preferences to the retirement planning scenario can help you view retirement in a more realistic way.

How Much Will You Need for Retirement?

Understanding your cost of living post-retirement is a crucial part of the retirement planning process. First, you need to understand how much your monthly cost of living expenses will be. This could include:

- Housing expenses

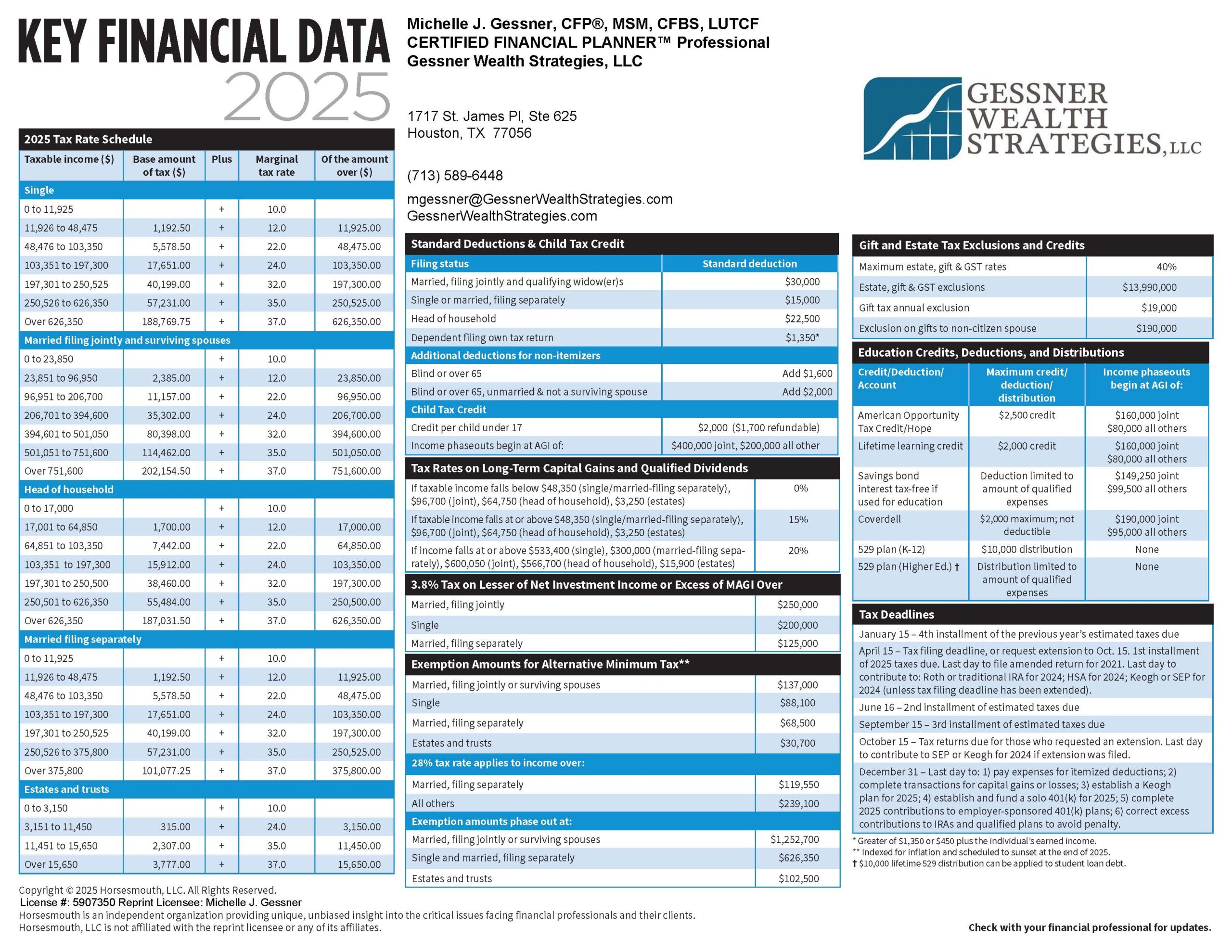

- Taxes (Local, State, Federal)

- Property taxes (if you own a home)

- The monthly cost of living (food, utilities, gas)

- Mortgage or rent expenses

- Car payments, if appropriate

- Medical expenses

- Insurance expenses

- Non-essential expenses such as travel, dining out, shopping, sporting activities, etc.

Once you have your estimated monthly expenses, you can then determine how much predictable income you have post-retirement. This income could be in the form of Social Security payments, pension draws, IRAs, annuities, etc.

Once you understand your income and your outflow, you can make wiser decisions about how much you will need to take out of your retirement savings each month/quarter/year for living expenses.

If you have more expenses than income, then it’s time to reevaluate your living expenses (or change your savings rate or investment strategy) or consider postponing your retirement for a few more years until you have the funds to live your current lifestyle.

A Popular Rule of Thumb

A popular rule of thumb states that you’ll need 80% of your final pre-retirement income for each year of retirement. Subscribing to this approach means that if you make $200,000 in the year before retirement, then you’ll need $160,000 saved up for each year you plan to retire.

However, taxes and inflation are not factored into these numbers. That’s why using the 80% rule is oversimplified and not accurate retirement planning, but simply a place to start. Remember as well that this amount of savings isn’t just for financing your fun activities. It’s also meant to meet the rising cost of medical care and other unpredictable challenges that arise.

Managing Social Security Benefits

The three options you have for managing your Social Security benefits are working longer, delaying when you start taking benefits, taking a reduced benefit, changing your savings rate or investment strategy or consider postponing retirement. Each of these decisions can be part of your overall retirement strategy.

The Benefits of Working a Bit Longer

Working longer can be an important part of your retirement plan. It helps delay the start of receiving Social Security benefits and increases their value over time.

Working longer also increases your earnings record, which means larger monthly Social Security payments when you are ready to retire as you have contributed more to the Social Security fund over time.

If you’re still working after full retirement age, then it may make sense to continue contributing to 401(k) plans and other tax-advantaged accounts. However, there may be tax implications if you are taking Social Security and earning a salary. Check with your financial planning professional to confirm.

Delaying Your Social Security Benefits

Deciding when to start your Social Security depends upon your income needs. By delaying the start of your payments between the ages of 66 to 70, your payment amounts can increase 8% per year, which could be a substantial boost to your monthly income stream.

In fact, waiting until age 70 could net you far better income than if you immediately began receiving benefits at age 62. It may be tempting to start earlier, but waiting until full retirement age (FRA), clearly, can yield better results.

We encourage you to work with a CFP® who can help you with tax planning and who can assist you in developing financial models for your retirement to optimize your income post-retirement.

States That Tax Social Security Benefits

One other consideration is that only 12 states levy a tax on Social Security benefits. While it may factor into your decision of where to retire, other considerations include climate, proximity to medical care, and your family’s location.

These are the 12 states that impose a tax on Social Security benefits, in addition to the Federal tax:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

Account for All of Your Income Sources

When you’re considering your retirement planning, it’s important to account for all of your income sources, including any assets or debts that you have, as well as income from sources other than Social Security and pensions.

The types of assets you should remember when planning for retirement can be divided into five categories:

1. Guaranteed Income such as Social Security benefits

2. Pension Plans

3. IRAs

4. Retirement Savings such as 401(k)

5. Other non-retirement accounts, such as certificates of deposit

By considering each source of income, you can create a much more accurate plan for what you’ll need for retirement. If the process seems overwhelming, remember that you can enlist the help of a CERTIFIED FINANCIAL PLANNER™ practitioner to help with the process.

Seek Help From a Fiduciary Wealth Advisor

Many investors will get to a point where they feel lost, confused, or even overwhelmed at the retirement planning process. It’s for that reason that many Americans neglect investing altogether.

There’s no shame in enlisting help when it comes to investing and managing your assets. When you do, ensure that the professional you hire is a fiduciary wealth advisor, since that obligates the advisor to act in your best interest.

Understanding the Fiduciary Standard

Fiduciary wealth advisors are held to a higher standard of care than other financial professionals, such as stockbrokers. Fiduciary wealth advisors are required by law to act in their client’s best interests at all times.

This means that they cannot receive any commissions or fees from the investment products they sell you—they are typically paid either a flat fee or an asset-based fee that is based on the amount of assets that they are managing for you.

If you’re looking for someone who can help guide your retirement planning efforts, a qualified fiduciary advisor is often a solid option.

Let Gessner Wealth Strategies Take the Guesswork Out of Your Retirement

At the end of the day, there’s no way to predict the future. That’s why it’s so important to plan for retirement now, while you can still make decisions that expand your portfolio.

Our professionals at Gessner Wealth Strategies can perform a risk assessment and guide you through the retirement planning process, complete with stress testing of your comprehensive financial plan. It all begins with a no-obligation meeting with Michelle Gessner, CFP®.

We provide all of the financial services you need, including tax strategies, estate planning, and much more. Simply fill out our contact form to get started.

Ready to take more steps towards a retirement you’ll love? As one of the most trusted wealth management firms in Houston, Gessner Wealth Strategies provides a no-pressure approach to helping clients plan for retirement. Connect with us at your convenience to learn more about our process and services.