Our financial planners are committed to helping you build the life you love. We create a wealth management strategy that tells your unique story. At Gessner Wealth Management, our financial advisors provide support with tax planning, cash flow analysis, asset management, and overall financial strategy. In addition, our clients enjoy access to a network of tax experts, realtors, and insurance professionals to ensure you are getting the best service in all areas of your financial strategy. Our portfolios are based upon Nobel prize-winning academic research and a growing body of knowledge that shows the advantages of a well-diversified portfolio. We work with business owners, retired professionals, and high-net-worth individuals. Start by booking a complimentary 15-minute phone call with our team to see how a financial planner can support your vision for the road ahead.

Why Work With a Financial Planner?

There are so many ways to utilize the skills of a financial planner. From preparing for retirement to maximizing your investment portfolio, a financial planner can facilitate a saving, spending and investing strategy that targets your goals. Once you become a client with Gessner Wealth Strategies, your financial planner will spend time analyzing your current portfolio alongside your future vision. Once we understand what matters to you most, we will draft a customized roadmap including services like:

- Financial Planning

- Investment Portfolio Management

- Retirement Planning

- Tax, State and Trust Planning

- Cash Flow Analysis

- Risk Management

- Employer Benefit and Retirement Plan Reviews

- Financial Organization and Security

- Large Purchase Planning and Analysis

Financial Planning Services

Depending upon where you are in your financial journey, you may require a unique combination of financial services to achieve your economic dreams. Our financial advisors utilize a combination of tools to help you generate income, protect your financial security, reduce taxes in retirement, and make monetary decisions. As a comprehensive wealth management firm, our financial planners provide support with:

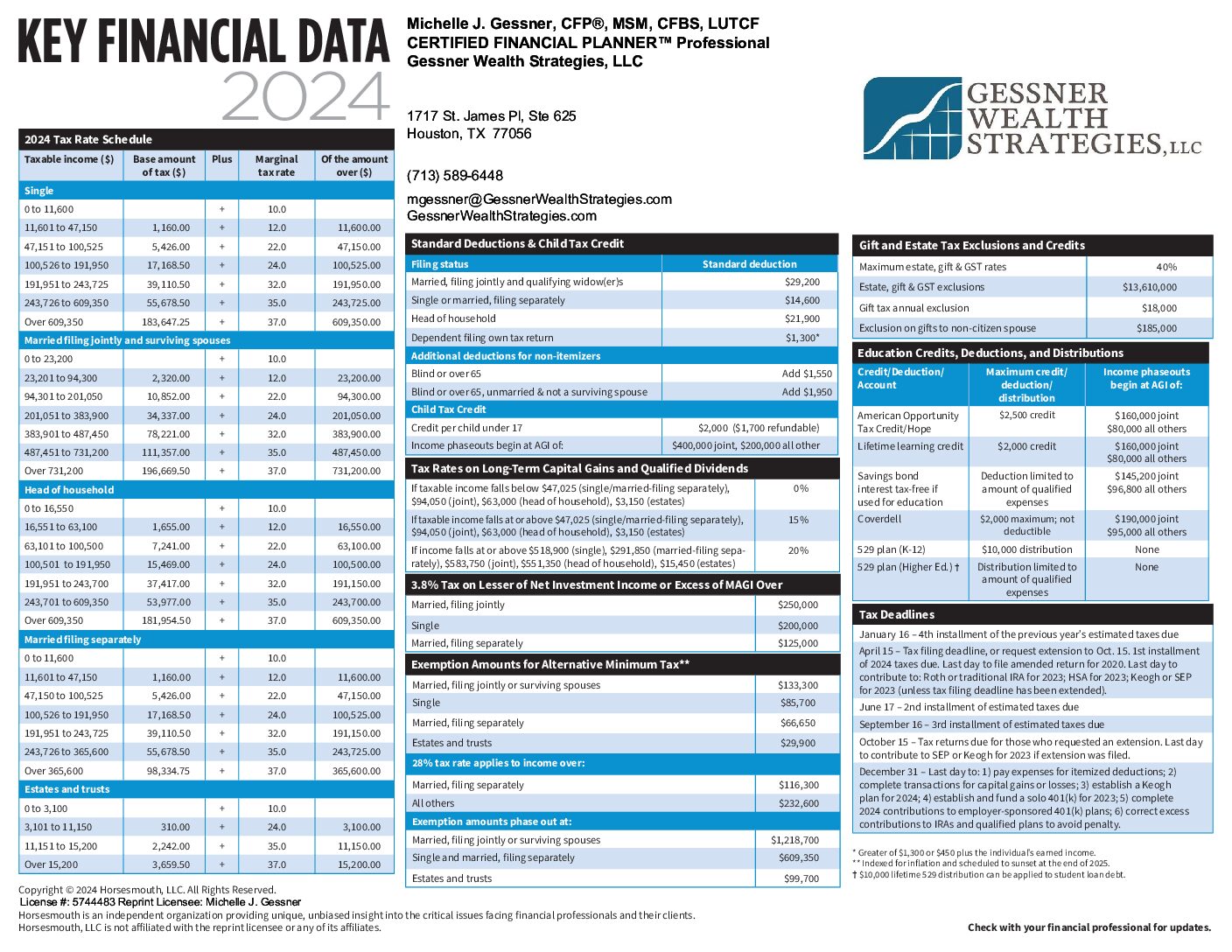

Tax Planning Services

State and federal tax codes are extremely complex. Strategizing with a financial planner can save you valuable time and money. With in-depth knowledge of federal tax regulations, our team can ensure that you are following a plan that supports your economic goals. While we will cannot prepare your tax return or write a will, we do spend time understanding your current tax return and how changes could impact it. We will recommend strategies that we think could help reduce your tax liabilities and work with your CPA to ensure alignment. Learn more about tax strategy on our blog, or book a consultation to get advice from our team.

Investment Strategy

Our independent team of investment professionals create portfolios designed for long-term investors. Whether you are new to investing or hold a seasoned portfolio, a financial planner can help you make investment decisions that align with your holistic wealth strategy. A financial planner can also organize your assets for better clarity on what’s working and where you have room for growth.

Preparing for Retirement

A financial planner can review your current retirement program and identify any risks or opportunities. In fact, after working with a financial planner, many clients learn they have more options than they expected. Get the latest insights on retirement planning here.

Cash Flow Analysis

One part of your wealth management strategy should include an up-to-date cash flow analysis. During this in-depth review, a financial planner forms an accurate picture of your current spending and how it aligns with your long-term goals.

Risk Management to Protect Wealth

At Gessner Wealth Management, our financial planners help you prepare for the unexpected. With access to a network of experienced insurance providers, you’ll be able to select an appropriate plan that maximizes your security while supporting your growth. Watch Michelle Gessner discuss financial preparation for emergencies during a lecture at Houston Community College.

Employer Benefit and Retirement Plan Reviews

As a business owner, creating employee benefits is a complex undertaking. The experienced financial planners at Gessner Wealth Management offer guidance on employee benefit contract negotiations and retirement plans.

Client Financial Triage

By aggregating all of your assets, a financial planner may uncover economic opportunities or streamline your investment strategy. After a detailed analysis of your accounts, you may find gaps or trends in your economic.

Large Purchase Planning

When planning a large purchase or buying a rental property, a financial planner offers economic clarity on how this asset will enrich your holistic wealth strategy. They can also shed light on potential savings and tax strategies that compliment your purchase.

Insulate yourself

from the crush of higher taxes

IMPORTANT QUESTIONS TO ANSWER NOW BEFORE IT’S TOO LATE

Are you doing everything you can to protect yourself from higher taxes in retirement? Download our complimentary guide and find out today!