In our last piece, we wrote about how recency bias can damage your investments by causing current crises to loom large, while rewriting your memories of past challenges. Recency tricks… Read More

Combat Recency Bias: Focus on the Basics

Information presented is for educational purposes only and is not intended to make an offer or solicitation for the sale or purchase of any securities. Gessner Wealth Strategies, LLC's website and its associated links offer news, commentary, and generalized research, not personalized investment advice.

In our last piece, we wrote about how recency bias can damage your investments by causing current crises to loom large, while rewriting your memories of past challenges. Recency tricks… Read More

Will your cash flow be tight? Do you want to rebalance your investment and retirement accounts? Were you planning to retire in the near future? These are just a few… Read More

We’re not making light of this summer’s uncertainties. Inflation is real, and needs to be managed; we also can’t rule out the possibility we’ll still see stagflation and/or a recession… Read More

Even though we know it was just dumb luck, can we get a round of applause for seeming to forecast July’s surprisingly strong market returns? It’s almost (but not really)… Read More

Having a marketable idea or set of skills is essential to owning a successful and prosperous business. However, it’s just not enough to ensure good financial health. Like anything else… Read More

One of the most common questions we get from individuals and business owners, as CERTIFIED FINANCIAL PLANNER™ practitioners in Houston is this: “How do we lower our taxes?” From business… Read More

Did you know that the average retirement lasts around 25 years in America? Imagine the preparations you’d need to make to live without your primary income for 25 years. The… Read More

Your investments are properly managed by experts in a well-constructed and diversified portfolio and you are saving at the appropriate rate for your financial goals. You are all set, right? … Read More

When planning for retirement, we frequently think about how much money we should have saved, where we would like to live, and at what age we would like to retire…. Read More

We hear it often. “Buy real estate as a great investment for your money.” Is that good advice? Let’s take a look at some of the considerations. Taxes and Toilets…. Read More

Gessner Wealth Strategies, LLC

1717 St James Place,

Suite 625

Houston, Texas 77056

Office Phone: 713-589-6448

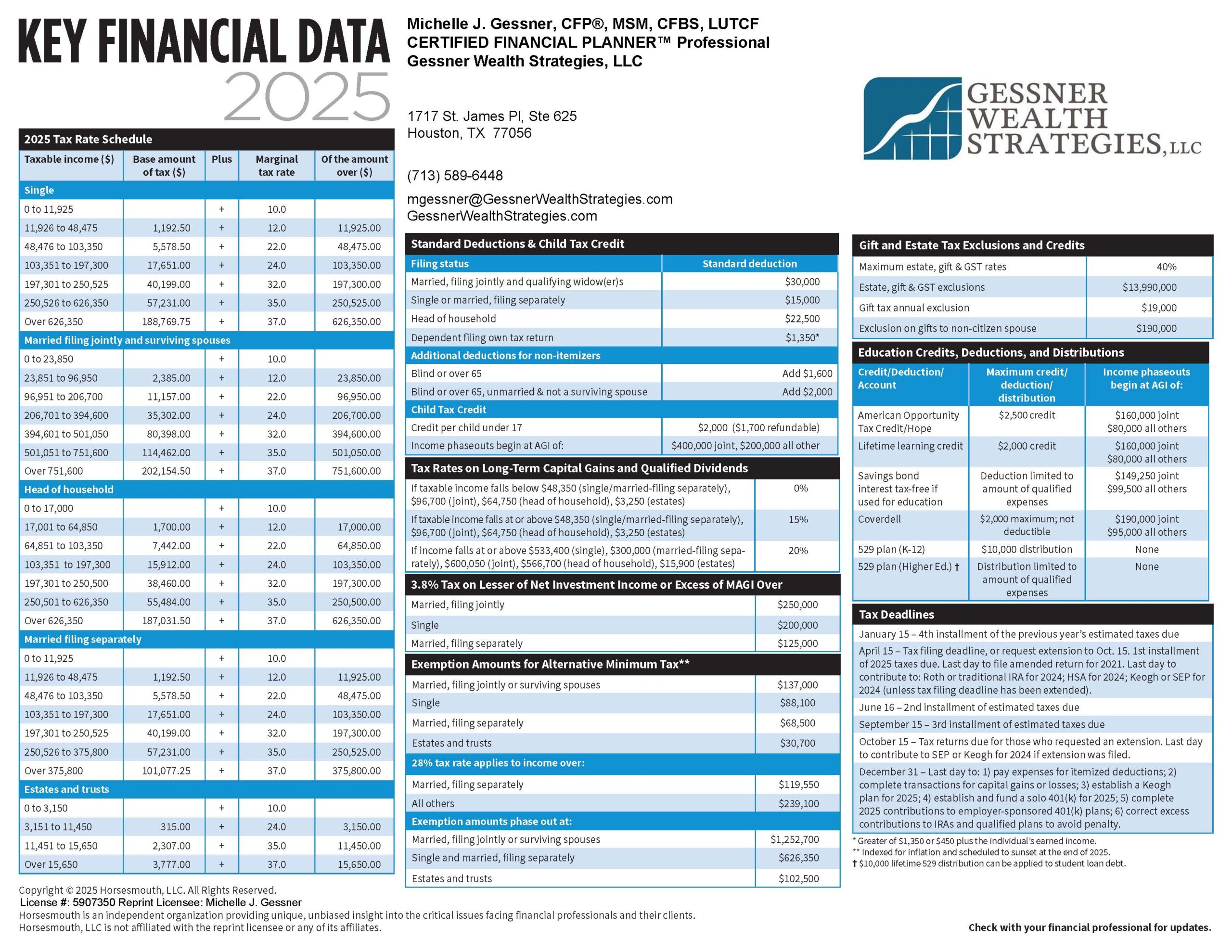

This quick reference guide (PDF) provides the most important figures you need for 2025 tax planning.

No thanks, I don't need it!

Download our white paper!

Just fill in your details below to be sent your copy of

“Evidence-Based Investment Insights: 12 Essential Ideas for Building Wise Wealth“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Download this complimentary guide and find out today!

Just fill in your details below to be sent your copy of “Will Higher Tax Rates Crush Your Retirement Gains?“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Answer the questions in this FREE Guide to find out!

Just fill in your details below to be sent your copy of “6 Important Questions to Ask Yourself Before Considering Retirement“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Get answers to critical estate planning questions… complete your details below to receive a copy

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.