Is an annuity a good move? It’s very confusing to determine fact from fiction with the plethora of information written about annuities on the internet. Like most everything else in… Read More

Annuities: Are They a Good Move?

Is an annuity a good move? It’s very confusing to determine fact from fiction with the plethora of information written about annuities on the internet. Like most everything else in… Read More

With cyber theft on the rise, cybersecurity has become a huge concern among businesses and individuals alike. It is therefore very important to understand how to protect your investment accounts… Read More

The biggest mistake people make when making the jump from renter to homeowner is underestimating the total cost of owning a home. Remember, as the homeowner, you are responsible for… Read More

You’ve done a good job of saving money over the years by watching your budget, living within your means, investing your money carefully, and putting in place risk management strategies… Read More

Smart people shouldn’t need to hire a financial planner or professional investment manager, right? After all, smart people can read and research to inform themselves and therefore they can take… Read More

“I cannot wait to pay the premiums for my homeowner’s, car, and long term care insurance policies,” said NOBODY ever. Insurance is one of those “necessary evils,” that we spend… Read More

If you have inherited an IRA, there are some important rules you must know to avoid some painful and irreversible consequences. The very first step to take is to contact… Read More

You probably know that when you reach the age of 70½ you are required to make annual withdrawals from your retirement accounts upon which you will be taxed. There is… Read More

Until very recently (2018), bond brokers were not required to disclose the markup that they are charging for the bonds they sell to their clients. Even today, while the markup… Read More

How Fees Work: There are three types of fees associated with mutual funds that are charged to the investor: Expense ratios: All mutual funds have expense ratios, which range from… Read More

Gessner Wealth Strategies, LLC

1717 St James Place,

Suite 625

Houston, Texas 77056

Office Phone: 713-589-6448

Download our white paper!

Just fill in your details below to be sent your copy of

“Evidence-Based Investment Insights: 12 Essential Ideas for Building Wise Wealth“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

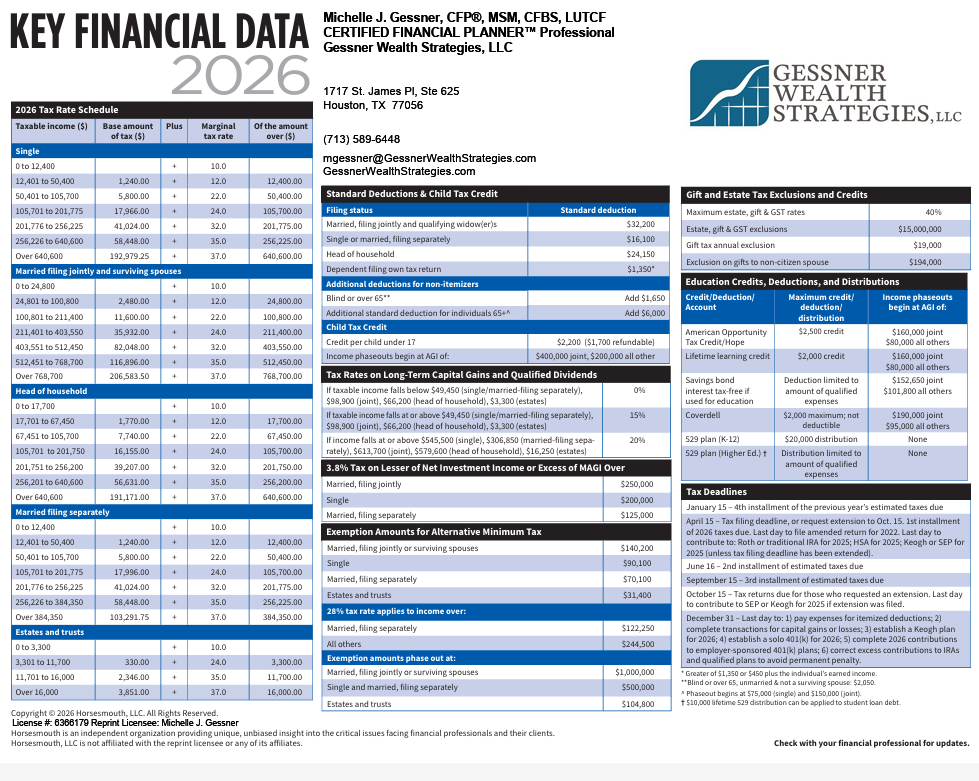

This quick reference guide (PDF) provides the most important figures you need for 2026 tax planning.

No thanks, I don't need it!

Get answers to critical estate planning questions… complete your details below to receive a copy

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Download this complimentary guide and find out today!

Just fill in your details below to be sent your copy of “Will Higher Tax Rates Crush Your Retirement Gains?“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Answer the questions in this FREE Guide to find out!

Just fill in your details below to be sent your copy of “6 Important Questions to Ask Yourself Before Considering Retirement“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.