On July 4th, a massive new tax bill quietly passed, stretching nearly 900 pages. While few people will read it cover to cover, the changes inside could affect retirees, families, and working professionals in meaningful ways.

Higher Standard Deductions

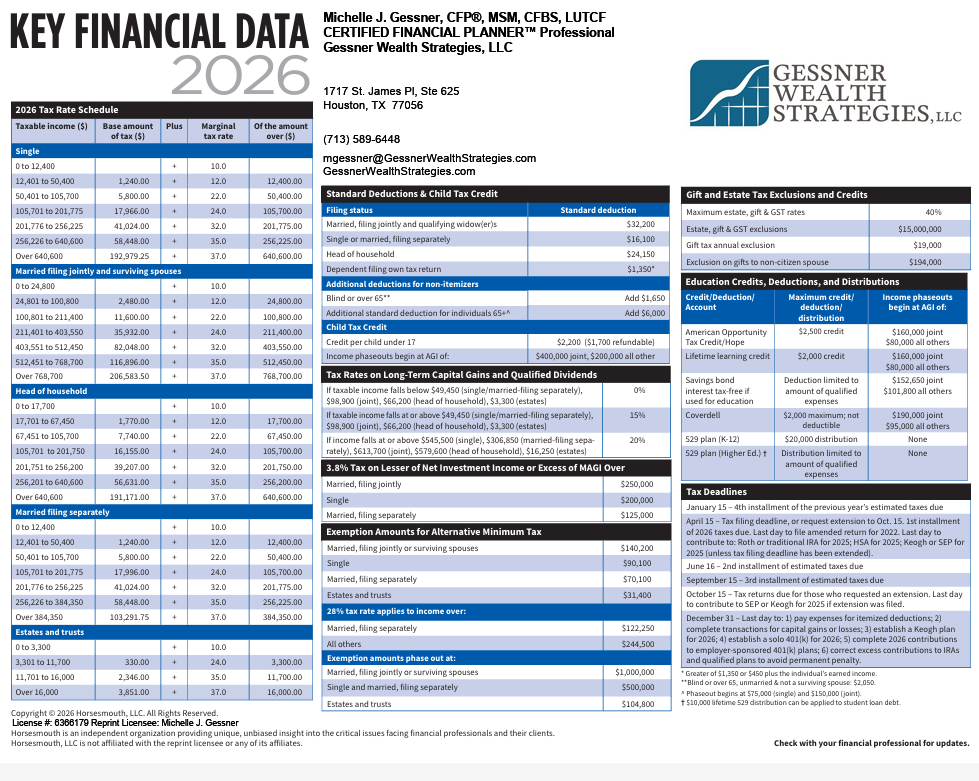

The good news is that standard deductions are going up. For married couples filing jointly, the deduction rises from $30,000 to $31,500. For single filers, it increases from $15,000 to $15,750. Since most taxpayers use the standard deduction, this change could bring immediate tax savings.

Changes to SALT and Senior Deductions

For those who live in high-tax states or own property with significant taxes, the state and local tax (SALT) cap has quadrupled from $10,000 to $40,000. While this could provide welcome relief, it comes with a sunset date: 2028. After that, the provision may expire unless extended.

Seniors also receive additional benefits. Individuals age 65 or older now qualify for an enhanced deduction of up to $6,000 per person, on top of the existing senior deduction. While income limits apply, this could still provide meaningful savings for many retirees.

Support for Families

Families will see an increase in the child tax credit from $2,000 to $2,200, with adjustments for inflation starting next year. In addition, new “Trump accounts” are being introduced for children born between 2025 and 2028, seeded with a one-time $1,000 contribution. While more restrictive as compared to 529 plans, these accounts offer another tool for long-term saving.

Expanded 529 Plan Benefits

529 accounts are also receiving expanded uses. In addition to tuition and books, families can now use 529 funds for standardized testing, tutoring, and even homeschooling support. Withdrawal limits have also doubled, creating greater flexibility for parents.

Other Notable Changes

- Auto Loan Interest Deduction: Interest on qualifying new auto loans, up to $10,000 per year, may now be deductible if the vehicle is assembled in the U.S. Guidance from the IRS on this new deduction can be found here and it is important to note that you can identify if your new car purchase was assembled in the US by visiting this VIN Decoder.

- Overtime and Tips: Certain overtime wages that fall under Fair Labor Standards Act rules may be eligible for partial deductions, though income limits apply.

- Charitable Giving: Starting in 2026, taxpayers who take the standard deduction may also claim up to $1,000 ($2,000 for couples) in cash charitable contributions, subject to income thresholds and a new floor.

Why It Matters

The key takeaway is that many of these provisions are temporary, expiring in 2028. That makes it essential to plan ahead now and take advantage of the opportunities available while they last.

At Gessner Wealth Strategies, Michelle and her team regularly run tax projections to help clients see how new laws may affect their unique situation. Understanding these changes today means you can make more informed decisions before tax season arrives.