Selling your home isn’t just about timing the market or baking cookies before an open house. It’s a financial transaction that, if done carelessly, can cost you tens of thousands of dollars and invite unnecessary stress.

Whether you’re planning to list soon or years from now, avoiding these common mistakes can make the difference between a smooth sale and a regret-filled experience.

1. Waiting Too Long to Handle Repairs

If you’ve been putting off fixing that leaning fence or dripping faucet, you’re not alone. But bundling years of deferred maintenance into a last-minute sprint before listing can be overwhelming and expensive.

More importantly, buyers notice. Especially in a high-interest-rate environment, where there are fewer buyers and more scrutiny, small issues can derail your deal or lead to costly negotiations.

What to do instead: Handle repairs gradually. Think of them as protecting your investment, not just prepping for a sale.

2. Guessing at the Right Price

Pricing your home too high can scare off serious buyers. Pricing it too low? You leave money on the table. Either scenario can lead to frustration and missed opportunities.

While online tools can give you a rough estimate, they can’t see your new roof or updated HVAC system. A good real estate agent can interpret market comps, adjust for unique features, and guide you through a pricing strategy.

Tip: Interview more than one agent and beware of pricing that’s “too good to be true.” Sometimes, the highest suggested listing price is just a tactic to win your business.

3. Overlooking Capital Gains Tax Rules

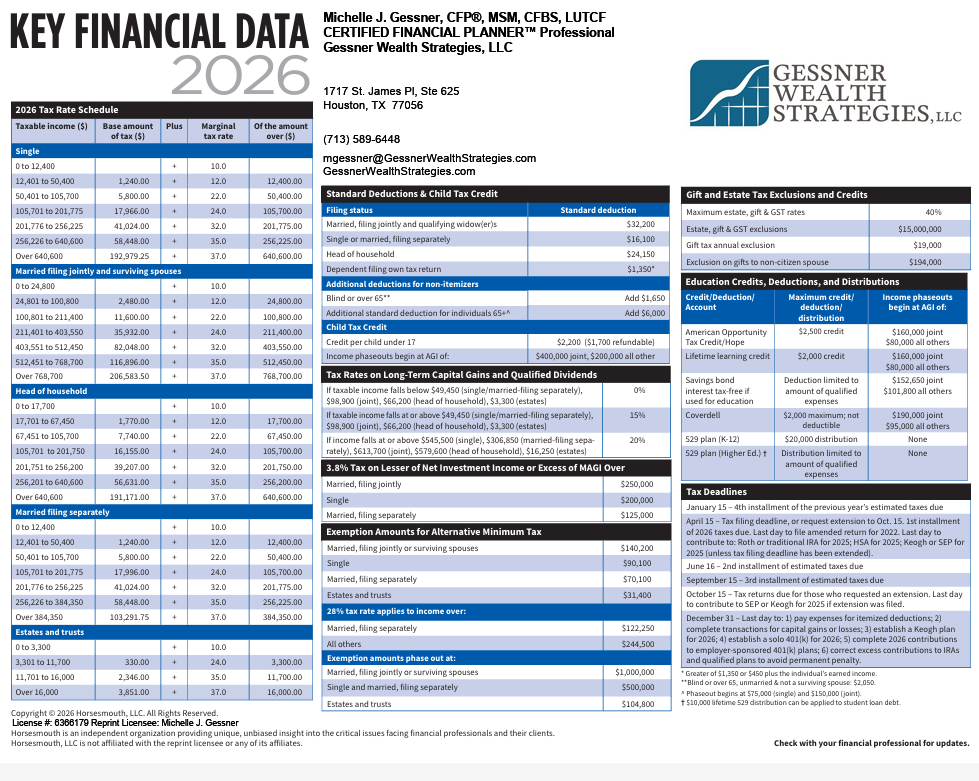

If your home has appreciated significantly, you might owe capital gains tax on the profit when you sell. But the IRS provides generous exemptions, $250,000 for single filers and $500,000 for married couples filing jointly, if the home has been your primary residence for at least two of the last five years.

Still, there’s a catch: any profit above that threshold could be taxable at long-term capital gains tax rates.

What helps reduce that tax bill? Documented capital improvements. Replaced your roof? Remodeled the kitchen? Added a pool? Those costs can offset your gain for tax purposes, but only if you’ve saved the receipts.

4. Ignoring the MLS Description Details

Most buyers start their search online. That means your home’s photos and written description do more than entice; they often determine if a buyer ever steps through the door.

Too often, important selling points like new plumbing, a recently replaced HVAC system, or energy-efficient upgrades are left out of the MLS description. If they’re not mentioned, buyers may assume they don’t exist.

Make sure your listing reflects not just aesthetics, but function and value.

5. Misunderstanding Inspection Report Obligations

Once a buyer shares their written inspection report with you (or your agent), you’re legally obligated to share it with future buyers if that deal falls through. That report, and whatever’s in it, becomes part of your home’s paper trail.

If you don’t fix the flagged issues or provide written context, your next potential buyer may walk away, too.

Pro tip: Don’t ignore or dismiss small problems. Address them, or explain clearly why they’re not a concern.

6. Making Assumptions on the Seller’s Disclosure

The Seller’s Disclosure isn’t just paperwork; it’s a legal document. If you check “no” on a question about flooding or structural damage and it turns out to be false, and it can be proven that you knew about it, the buyer may be entitled to triple damages in a lawsuit.

Even innocent mistakes can lead to serious consequences. When in doubt, say “I don’t know” and never guess.

Bonus Tip! Forgetting the Emotional Side of the Sale

When you’ve lived in a home for years, it’s easy to assign sentimental value to every fixture and finish. But buyers won’t see it the same way. They’re evaluating risk, lifestyle fit, and cost.

Getting too emotionally attached to your asking price or being too defensive about feedback can stall a sale before it starts.

Selling is part business, part psychology. Working with professionals, both financial and real estate, can help you stay focused and supported throughout the process.

Ready to Sell Smart?

Selling your home should feel like a confident step forward, not a guessing game.

For guidance on how this decision fits into your broader financial strategy, reach out to our team at Gessner Wealth Strategies or call (713) 589-6448.

Let’s make sure your next chapter starts strong.

Stream the episode of Retire To A Life You Love® on this topic for even more insight!