As the old year draws to a close and a new one begins, millions of Americans will once again make New Year’s resolutions. For many, these resolutions focus on health… Read More

Five Behavioral Finance Resolutions for a Better Financial Year

As the old year draws to a close and a new one begins, millions of Americans will once again make New Year’s resolutions. For many, these resolutions focus on health… Read More

Over the next few decades, an enormous amount of wealth is expected to pass from older to younger generations. This has been dubbed the “Great Wealth Transfer,” and one estimate… Read More

In May, legendary investor Warren Buffett announced he will retire as CEO of Berkshire Hathaway at the age of 95. Sixty years ago, Buffett took over Berkshire Hathaway, a struggling… Read More

Scroll through your social media feed after a major move in the market, and you’ll see a flood of hot takes, bold predictions and “can’t-miss” tips. Welcome to the age… Read More

The earlier you start investing, the better. You’ve heard this advice before, and hopefully it’s helped you make some smart financial moves. But there’s one group that may not yet… Read More

Ah, we restless humans. Sometimes, it pays to strive for greener grass. But as an investor, second-guessing a stable strategy can leave you in the weeds. Trading in reaction to… Read More

In a bit of a paradox, you’ll find the following two titles on our recommended reading list: The Wisdom of Crowds, James Surowiecki (2005) Memoirs of Extraordinary Popular Delusions and… Read More

Nobody wants to make investment mistakes. And yet, we’re human; mistakes happen. Here’s how to minimize the ones that matter the most, and make the most of the ones that… Read More

In our last piece, we summarized the ways a successful stock buyback can deliver powerful, tax-efficient value to shareholders, without stunting future growth. But stock buybacks are like any other… Read More

In our last piece, we explained how stock buybacks generally work, and why we prefer investing in a globally diversified investment portfolio over chasing or fleeing particular buyback opportunities. Next,… Read More

Gessner Wealth Strategies, LLC

1717 St James Place,

Suite 625

Houston, Texas 77056

Office Phone: 713-589-6448

Download our white paper!

Just fill in your details below to be sent your copy of

“Evidence-Based Investment Insights: 12 Essential Ideas for Building Wise Wealth“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

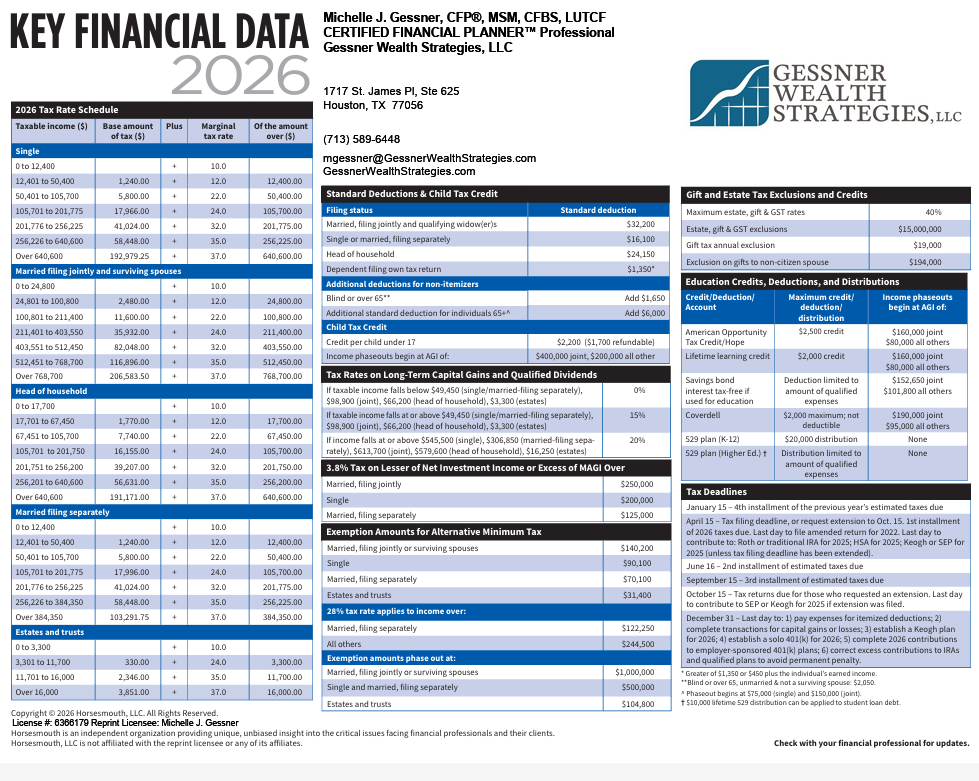

This quick reference guide (PDF) provides the most important figures you need for 2026 tax planning.

No thanks, I don't need it!

Get answers to critical estate planning questions… complete your details below to receive a copy

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Download this complimentary guide and find out today!

Just fill in your details below to be sent your copy of “Will Higher Tax Rates Crush Your Retirement Gains?“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Answer the questions in this FREE Guide to find out!

Just fill in your details below to be sent your copy of “6 Important Questions to Ask Yourself Before Considering Retirement“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.