Tax planning may not be the most thrilling topic at a dinner party, but when it comes to preparing for retirement, it plays a central role. Knowing how different tax rules affect your financial picture can help you make more confident decisions, especially as you approach retirement. In this post, we’ll take a closer look at some of the key strategies and common missteps to watch out for as you navigate the complex world of retirement tax planning.

Why Taxes Matter More Than Ever

While taxes can seem like background noise for much of your working life, they often take center stage in retirement. This is particularly true for professionals over 50, and even more so for women managing both career milestones and long-term financial goals. Understanding how tax rules affect your income, investments, and healthcare costs can mean the difference between a retirement that feels secure and one that feels uncertain.

Let’s unpack a few of the more important tax topics that come into play during this phase of life.

Medicare IRMAA: The Surcharge That Sneaks Up

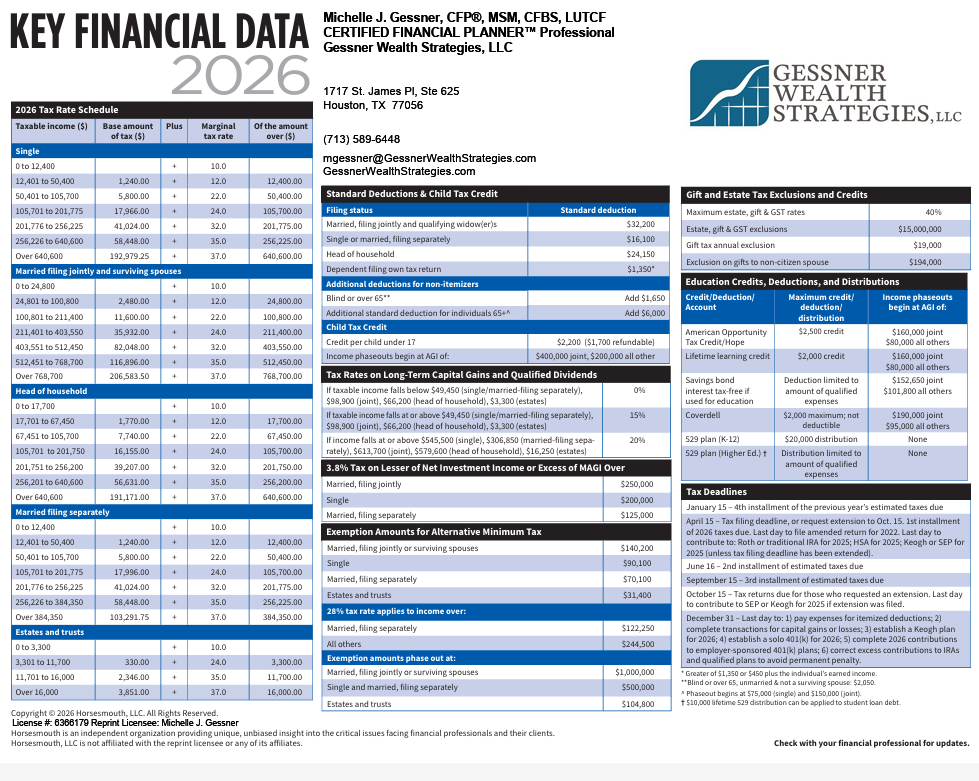

One item that often catches people off guard is the Medicare Income-Related Monthly Adjustment Amount, or IRMAA. This isn’t just a mouthful—it’s a surcharge that gets added to your Medicare premiums if your income exceeds certain limits. What makes IRMAA tricky is that it looks at your income from two years ago, not your current financial situation. That lag means you could be charged more than expected based on a past year’s income.

Keeping your income below IRMAA thresholds, when possible, can help you avoid these extra costs. That may involve adjusting how and when you take income from retirement accounts or making strategic decisions around capital gains.

Capital Gains and Losses: Timing Is Everything

Capital gains taxes can feel like a moving target, but one consistent strategy is tax-loss harvesting—selling investments at a loss to offset gains elsewhere in your portfolio. While the IRS allows you to deduct up to $3,000 in capital losses against ordinary income each year (a rule that hasn’t changed since the 70s), the real value comes from carrying over unused losses to future years.

This tactic can be especially helpful in years when your income is high or when you’re realizing large gains from other sources.

Social Security Taxes: A Quiet Drag on Income

Social Security benefits may be taxed depending on your income, and surprisingly, the income thresholds haven’t been updated since 1993. That means more retirees are now paying taxes on up to 85% of their benefits. And the thresholds for married couples are not much higher than for singles.

Even small shifts in your income, like taking required minimum distributions or receiving investment income, can push you into a higher tax bracket for Social Security. Planning withdrawals carefully, doing some strategic tax planning around the different tax buckets, and being aware of how different income sources interact can help keep taxes from taking a bigger bite than necessary on your Social Security..

The 3.8% Net Investment Income Tax (NIIT)

If your income crosses certain thresholds ($200,000 for individuals, $250,000 for joint filers), the Net Investment Income Tax adds another layer of tax to dividends, interest, capital gains, and more. Since those limits haven’t changed in over a decade, more professionals are finding themselves affected.

Strategies like rebalancing between Roth and traditional accounts or rethinking the timing of capital gains can help reduce exposure to this surtax.

Safe Harbor and Charitable Giving Strategies

If you’re drawing income from investments in retirement, you may need to pay estimated taxes throughout the year. The Safe Harbor rule helps you avoid penalties as long as you pay a certain percentage of your tax liability based on the previous year’s income and spread the tax payments evenly throughout the year

And if giving back is part of your plan, Qualified Charitable Distributions (QCDs) can be a smart way to donate directly from an IRA. Not only can QCDs satisfy your required minimum distributions, but they also reduce your taxable income, even if you take the standard deduction. This strategy is only available to people who are 70 ½ or older, and because it reduces your MAGI, it may help you lower your Medicare premiums.

The Rule of 55: Early Access with Fewer Penalties

Thinking about retiring before 59½? The Rule of 55 might be relevant. It allows penalty-free withdrawals from your 401(k) starting the year you turn 55—if you’ve left your job that year and the funds come from the plan tied to that employer. While not for everyone, it can offer more flexibility for those planning an earlier retirement transition.

Final Thoughts

There’s no one-size-fits-all playbook for retirement tax planning, but being aware of the rules—and the opportunities within them—can help you chart a more informed path forward. From avoiding Medicare surcharges to optimizing charitable giving, each choice has ripple effects that can shape your financial picture.

The tax landscape may be complex, but with curiosity, planning, and the right guidance, it becomes far more navigable.

Need some help? Connect with us for personalized solutions.