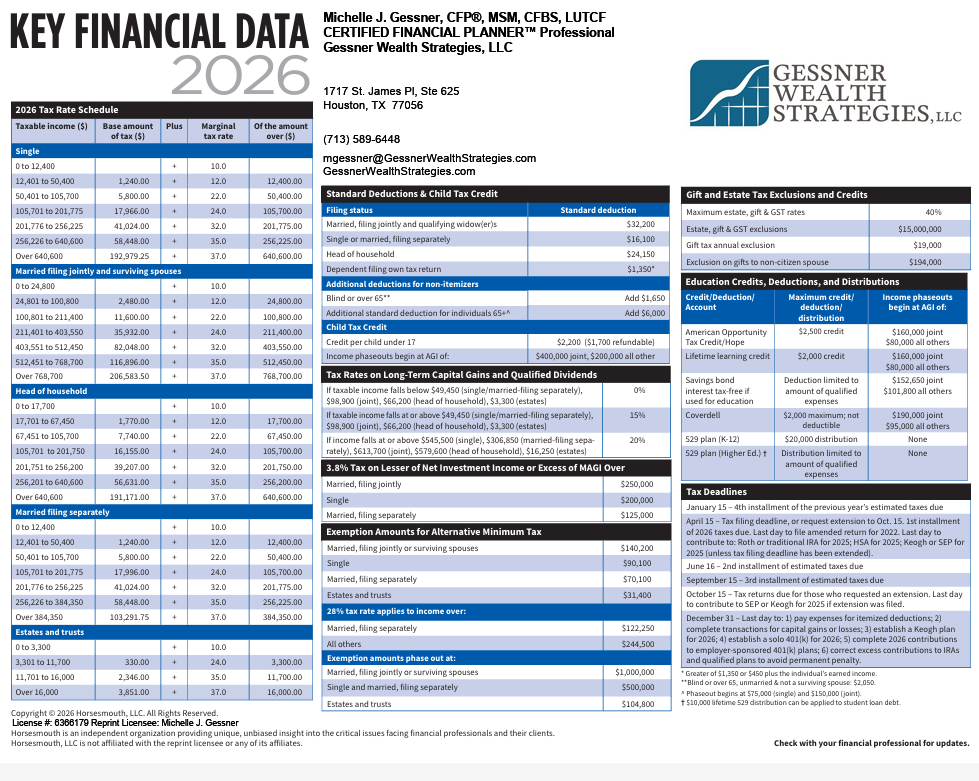

Filing your tax return may feel routine. But the devil is in the details, as they say, and those details have a pesky habit of shifting from year to year…. Read More

New Year, New Tax Considerations: What You Need to Know Before Filing Your 2025 Taxes