We all like hearing that we’re good at our jobs. It’s nice when kudos from your employer come bundled with dollar signs, or when a company backs up the cash… Read More

Equity Compensation: Big Opportunities, But Beware the Risks

Information presented is for educational purposes only and is not intended to make an offer or solicitation for the sale or purchase of any securities. Gessner Wealth Strategies, LLC's website and its associated links offer news, commentary, and generalized research, not personalized investment advice.

We all like hearing that we’re good at our jobs. It’s nice when kudos from your employer come bundled with dollar signs, or when a company backs up the cash… Read More

Doctors write prescriptions. Auto mechanics perform tune-ups. Lawyers prepare briefs. Financial advisors help you manage your money. Ultimately, it’s that simple. But like any other profession, we sometimes have a… Read More

The future looks bright for younger investors. A 2024 analysis by the Investment Company Institute found that, adjusted for inflation, Gen Zers have nearly three times more retirement assets than… Read More

With some 95% of its activity occurring subconsciously, your brain can be quite tricky. With every spontaneous signal, our cerebral synapses expose us to countless behavioral biases, duping us into… Read More

We’ve commented before on the mechanics of accumulating and preserving your wealth by building a low-cost, globally diversified investment portfolio aimed at your personal goals and risk tolerances. Today, let’s… Read More

Until recently, much of our investment advice has emphasized the importance of maintaining your investment strategy, even when it’s tempting to jump out during market declines. Year to date, tables… Read More

Today, let’s turn our attention to women and their wealth. Based on available evidence, what are women’s most likely superpowers as they acquire and manage personal wealth? What vulnerabilities might… Read More

In Part 2 of our three-part series on bringing order to your investment universe, we looked at Transitions and Taxes, or how to balance sensible tax management with effective investment… Read More

As we touched on in The Beauty of Being Organized, when you sell an investment for more than you paid for it, there can be burdensome capital gain taxes realized… Read More

When it comes to investing, our message has long been loud and clear: Build a well-structured portfolio to capture available market returns while managing the risks involved. Shape it to… Read More

Gessner Wealth Strategies, LLC

1717 St James Place,

Suite 625

Houston, Texas 77056

Office Phone: 713-589-6448

Download our white paper!

Just fill in your details below to be sent your copy of

“Evidence-Based Investment Insights: 12 Essential Ideas for Building Wise Wealth“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

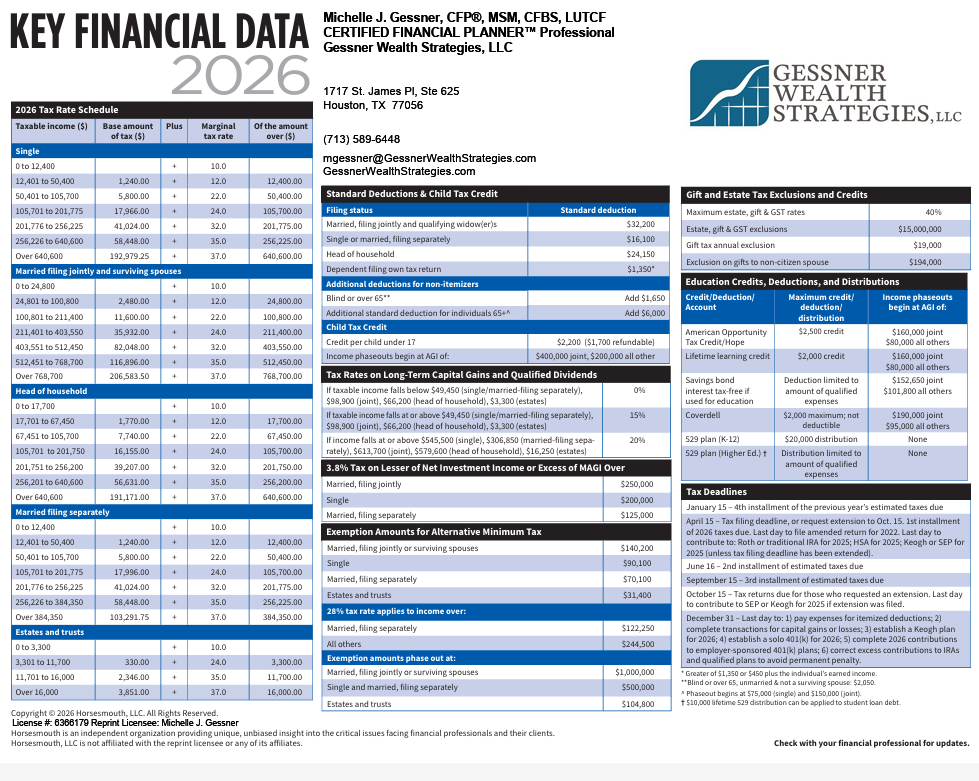

This quick reference guide (PDF) provides the most important figures you need for 2026 tax planning.

No thanks, I don't need it!

Get answers to critical estate planning questions… complete your details below to receive a copy

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Download this complimentary guide and find out today!

Just fill in your details below to be sent your copy of “Will Higher Tax Rates Crush Your Retirement Gains?“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.

Answer the questions in this FREE Guide to find out!

Just fill in your details below to be sent your copy of “6 Important Questions to Ask Yourself Before Considering Retirement“

By providing your details you’re agreeing to receive emails from Michelle Gessner & Gessner Wealth Strategies, LLC in the future. You can unsubscribe at any time.

We hate spam and will keep your email safe. For more details, view my privacy policy here.