-

Business Consulting with Limitless Potential

A financial consultant can help you invest wisely, reduce taxes, and retire to a life you love. At Gessner Wealth Management, our financial consultants are committed to helping you and your family make smart decisions about your wealth. We’ll help you visualize the next chapter and build a wealth strategy that reflects your vision. As an independent, fiduciary firm our financial consultants will only recommend products and investments that fulfill your needs. Our network of vetted professionals includes Tax Experts, Realtors, Insurance Professionals, and more.

Financial Consultant...

As financial consultants, we provide assistance with:

-

Financial Planning

-

Retirement Planning

-

Tax, Estate and Trust Planning

-

Cash Flow Analysis

-

Investment Analysis, Strategy and Implementation

-

Risk Management

-

Employer Benefit and Retirement Plan Reviews

-

Financial Organization and Security

-

Large Purchase Planning and Analysis

Learn more about becoming a client or contact us for additional information.

The Role of a Financial Consultant

A financial consultant delivers customized strategies to help you meet your wealth management goals. From investment planning to cash flow analysis, a financial consultant will build a holistic approach to making decisions about your money. Once we have a clear understanding of what is important to you, we’ll analyze your current current saving, spending, and income patterns. This information will allow your financial consultant to craft a detailed financial plan that includes “what-if” scenarios, conclusions, and implementation steps. As financial consultants, Gessner Wealth Management is committed to:

- Understanding your financial goals

- Discussing your investing history

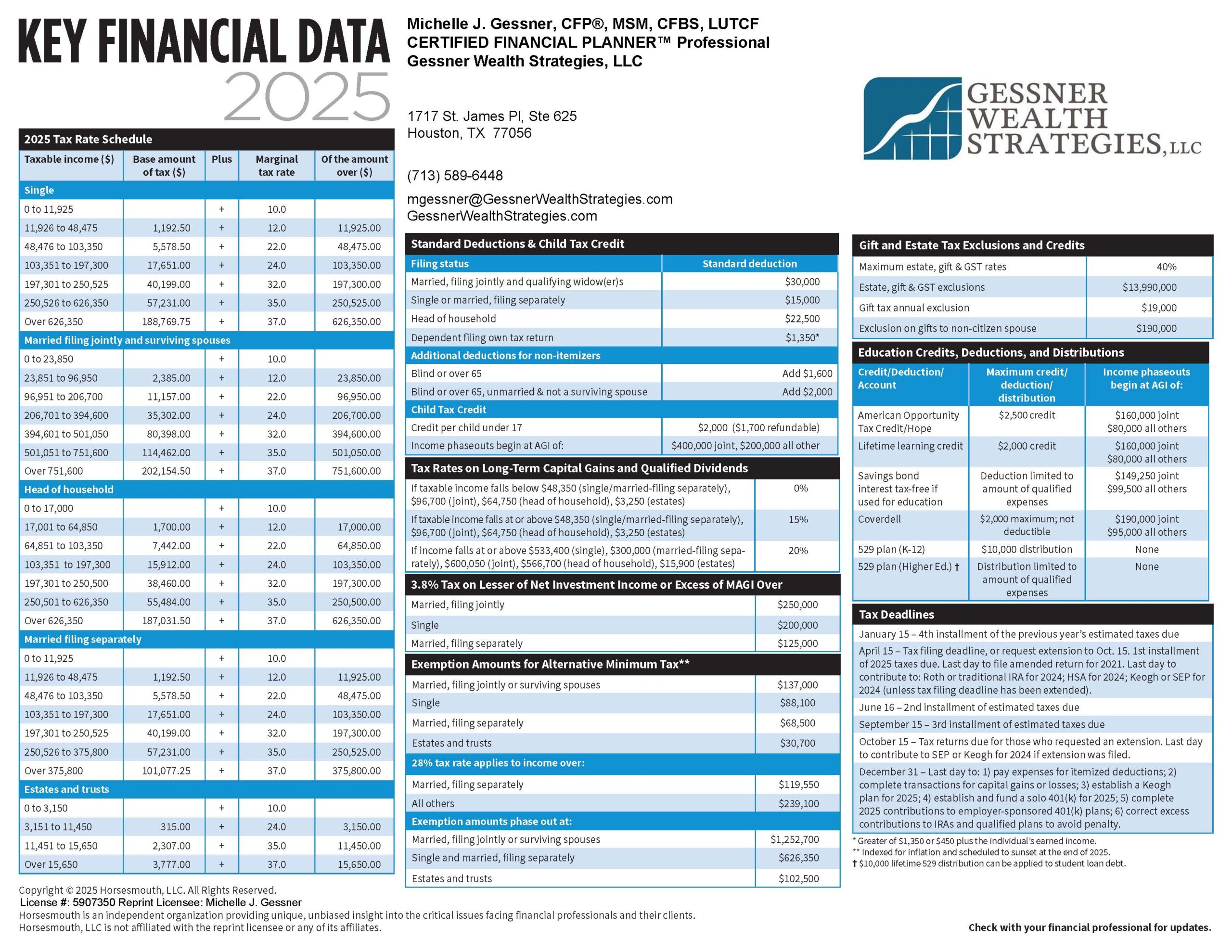

- Reviewing your tax strategy to provide maximum benefits

- Walking through future scenarios and managing risk

- Planning for retirement and ensuring financial security

We work with clients that have a minimum of $500,000 to invest in their retirement. The first step is scheduling a call with our team to discuss the expertise you need.

Our Services

Gessner Wealth Management offers customized financial services tailored to your economic goals. We provide assistance with financial planning, tax planning, retirement, investment, cash flow, risk management and more:

Financial Planning

A financial consultant creates and executes a financial plan that reflects your values and vision. Our team starts the process with a review of your income, expenses, investments, and upcoming transitions. During your first meeting, we’ll review your goals before offering observations and ideas to consider. You’ll be presented with an actionable, detailed plan and several check-in points along the way.

Tax Planning

A financial consultant creates and executes a financial plan that reflects your values and vision. Our team starts the process with a review of your income, expenses, investments, and upcoming transitions. During your first meeting, we’ll review your goals before offering observations and ideas to consider. You’ll be presented with an actionable, detailed plan and several check-in points along the way.

Retirement Planning

Planning on retiring to a life you love? A financial consultant can help. In fact, many of our clients find they have more retirement options than expected. We start by understanding your lifestyle today and how it may change in retirement given your current saving, spending and income. Our financial consultants provide guidance on bonds, annuities and 401k rollovers to maximize your retirement strategy.

Investment Analysis, Strategy and Implementation

Whether you’re a seasoned investor or new to the practice, a financial consultant can provide guidance on the right strategy to support your current and future economic well-being. Our team is up-to-date on the latest investing trends as well as knowledgeable on proven wealth management strategies.

Cash Flow Analysis

An accurate cash flow analysis is key to understanding your current and future spending. Using this data, a financial consultant can help you structure a wealth management strategy that supports your long-term goals. Contact our team to start the process or read more about becoming a client today.

Risk Management

A financial consultant can help you account for the unexpected. Long-term relationships are central to our ethos and we are passionate about standing beside you through the many changes life has to offer. Our financial consultants partner with a network of insurance providers in order to select the right plan for your protection. As an independent firm, we have the flexibility to only partner with the insurance provider that meets your needs.

Employer Benefit and Retirement Plan Reviews

Gessner Wealth Management can consult on employer benefit contract negotiations for both small and large businesses. Read our FAQs page for more information about our firm and getting started.

Financial Organization and Security

Organization is key to discovering financial opportunities within your current portfolio. A financial consultant will review and coordinate your accounts to provide a streamlined plan. To ensure the security of your finances we provide secure, encrypted filing technology to all of our clients.

Large Purchase Planning and Analysis

From providing a sounding board to support with asset management a financial consultant can optimize large transactions, like selling a business or buying a rental property. Our goal is to determine how this purchase aligns with your larger wealth management strategy.

About Us

Gessner Wealth Management was founded by Michelle Gessner, CFP®, MSM, CFBS, LUTCF. We work with people planning retirement, busy professionals, and diligent savers. If you are the financial decision maker in your life and have a minimum of $500,000 to invest in your retirement, we welcome the chance to discuss how we can work together for your success.